So many Us americans struggle with financial obligation. A study presented by Hometap during the 2019 regarding almost 700 U.S. people indicated that although property owners try home-rich, also they are cash-worst, with little to no go out-to-go out liquidity. Questionnaire takers indicated when they performed have loans-100 % free accessibility their house’s guarantee, such as for instance property security progress, that they had use it to pay off credit card debt, medical expense, if you don’t assist friends and family pay-off debt.

Of numerous homeowners answered which they have not even noticed options available to make use of their property equity. In a nutshell, they think caught due to the fact available financial options only apparently put alot more personal debt and you will attract into the homeowner’s month-to-month equilibrium sheet sets. Additionally there is the difficulty of certification and you will approval, because it’s difficult to be considered of numerous financial support choice, such as for example a home collateral loan, with bad credit.

What’s promising? It domestic steeped, bucks bad condition quo doesn’t have to carry on. Right here, you will then see regarding significance of borrowing, as well as how you could nonetheless availableness your house equity if your personal try very poor.

What is Borrowing from the bank and exactly why Can it Amount to help you Lenders?

Borrowing refers to the ability to to borrow funds, get situations, otherwise have fun with properties if you find yourself agreeing to add fee within an after go out. The expression credit history relates to a around three-little finger matter one implies the degree of honesty you exhibited during the the past compliment of knowledge of loan providers, lenders – essentially, any business having provided your money. This post is gained in the a credit file through a choice of different offer, like the quantity of credit cards you have, as well as people a fantastic stability to them, their reputation for financing and installment behavior, timeliness of monthly bill fee, and you can significant problems instance bankruptcies and you will property foreclosure.

Put differently, loan providers wish to be given that sure as possible which you yourself can spend back anything they provide to you personally, and you may examining their credit is an easy and you will seemingly comprehensive means to collect this article.

When you’re carrying a good amount of obligations and are also concerned about the borrowing, it might seem your domestic equity is actually unreachable. However with a unique, non-loans financial support solution offered to many home owners, you might be astonished at what you can accessibility. Listed below are some methods for you to utilize your house security first off using one to liquidity to-arrive your financial goals. ?

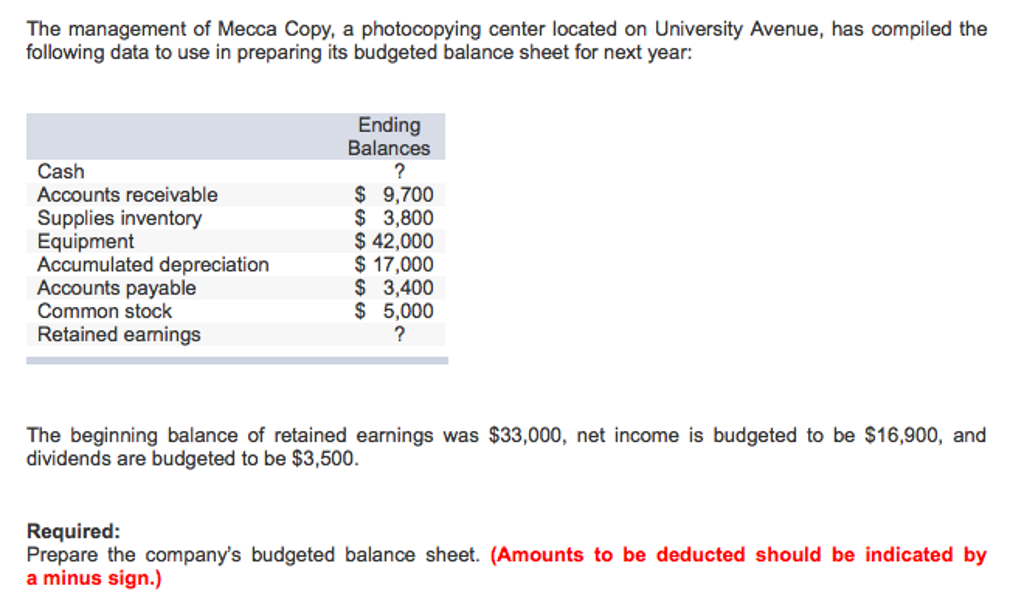

See the chart lower than to have an instant review of your options that could be on the market according to your credit score, upcoming continue reading for lots more from inside the-depth descriptions each and every.

Cash-Aside Re-finance

A profit-aside refinance occurs when your, the newest resident, take-out a different, larger financial, pay off your financial, and employ the extra to pay for your circumstances. This can be done using your established lender or another type of lender which is maybe not thought another mortgage. Centered on Bankrate , you generally you need at the least 20% security on your assets in order to qualify, and you may pay attract towards lifetime of the loan (usually fifteen otherwise three decades). From the long time of a funds-aside refi (once the they truly are identified), you should make sure the rate of interest along with your requested repayment package match their month-to-month funds. Residents are typically expected to enjoys a credit history minimum of 620 to get acknowledged to own a finances-out re-finance.

Family Equity Financing otherwise Household Guarantee Line of credit

Might you qualify for a property collateral financing or property security line of credit (HELOC) having bad credit? Very first, you have to know the difference between these two home collateral alternatives.

A home collateral loan makes you borrow funds by using the collateral in your home just like the equity. Good HELOC, likewise, works more like a charge card, in the same way you could mark cash on an as-required basis. Having both home equity fund and you may HELOCs, your credit score and you can family security well worth will play a member in the way much you’ll use and your interest rate.

The minimum credit score you’ll need for a property equity loan and you may an effective HELOC are usually about 620, though it relies on the lending company. But even though you usually do not fulfill that it minimum credit rating to possess a property equity loan or HELOC, avoid being frustrated. Julia Ingall which have Investopedia claims property owners having poor credit is review shop for loan providers accessible to coping with borrowers such him or her. On top of that, Ingall cards you to definitely handling a mortgage broker makes it possible to see your alternatives and you can help you credible loan providers.

Home Guarantee Progress

A home guarantee get better also offers homeowners the capacity to utilize the long run value of their property to accessibility their guarantee now. A property equity funding try a simple way doing simply that.

Within Hometap, homeowners can be discovered house guarantee investment to enable them to have fun with some of the guarantee they usually have accumulated in their home to do most other monetary specifications . The latest resident becomes bucks without the need to sell or take aside financing; and there is zero notice without monthly payment. . Various other positive aspect away from a good Hometap Money is that hundreds of circumstances try taken into consideration so you’re able to approve an applicant – credit history is not the identifying expectations.

Sell Your property

For the majority, its a last resort, but property owners which have poor credit can access its house’s equity because of the promoting it downright. Obviously, it decision are predicated on selecting a less expensive home to possess your next family, in addition to favorable home loan terminology for the this new put, and you can making sure you do not invest continuously to your a property charge or moving will cost you. You additionally might possibly alter your credit rating prior to you reach this time. Keeping track of your credit score to store an eye out getting potential disputes and you will inaccuracies, keeping an equilibrium better under your credit limit https://paydayloansconnecticut.com/rock-ridge/, and you can staying dated membership unlock are common an effective locations to begin with.

While perception family-steeped and cash-worst such as unnecessary People in the us , you now have many options to availability your residence guarantee. Just like any big funding choice, speak with a dependable economic elite group to decide your best path of action, and get moving toward your goals.

We carry out all of our better to guarantee that what when you look at the this post is once the precise that one may by the latest big date it is composed, but one thing changes rapidly sometimes. Hometap will not promote otherwise display one connected other sites. Personal issues differ, so speak to your own money, taxation or legal professional to determine what is sensible to you.

Comentarii recente