That have a great 680 credit history, the monthly mortgage insurance rates create simply be $ thirty days, which is a benefit away from $ 30 days. Even though you keeps the ultimate nontraditional credit history for all of the accounts your provide, the borrowed funds insurance policies price cards will lose the borrowing since if you have a credit rating towards the straight down section of the range.

FHA finance

An excellent nontraditional credit report becomes necessary

Brand new FHA really does wanted an independent 3rd party credit history in order to make sure one nontraditional borrowing pointers you bring. All borrowing from the bank organization, including your leasing site, should be verifiable of the an outside providers – for people who book regarding a close relative otherwise buddy, you won’t qualify for the loan.

Normally, you have to be able to bring an effective a dozen-week commission history away from three of following sourced elements of nontraditional credit to get sensed to possess an enthusiastic FHA financing with no FICO scores:

- Lease

- Cell

- Gas, fuel, water, television provider otherwise internet service

This new rent record is actually mandatory, but if you don’t possess several a lot more that are homes-relevant, the new FHA might consider the following the:

- Insurance premiums that aren’t deducted from your payroll (renters insurance, coverage)

- Childcare costs

- College or university university fees

- Percentage toward medical debts perhaps not covered by insurance rates

- 12-day noted history of normal dollars places to your a bank account that were at least made every quarter, and you will were not deducted out-of an income. That point usually do not become nonsufficient money (NSF) punishment

- A personal loan that have conditions written down and a beneficial a dozen day percentage records at a regular, set count

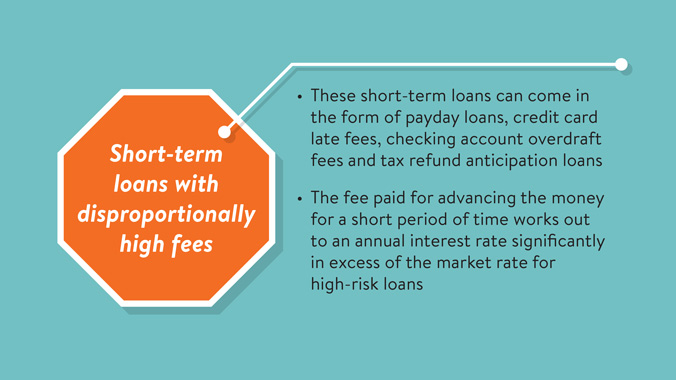

payday loans in Simsbury Center Connecticut

New commission record you should never mirror late costs during the last 12 months and no more than a few 31-big date late payments in the last a couple of years to the other given account records.

Downpayment and you will financial obligation-to-earnings percentages

As opposed to a credit history, the newest FHA doesn’t let the total loans proportion in order to exceed 31% into the payment per month compared to the money, and you can 43% having overall financial obligation separated by income. This is exactly a stricter requisite as compared to allowances to own consumers with fico scores, having conditions sometimes offered upwards significantly more than 50% with a high credit history.

The standard downpayment from 3.5% try acceptance getting consumers and no credit history, there are no additional limits.

FHA mortgage insurance rates rather than a credit rating

One to benefit of an enthusiastic FHA mortgage more than a traditional financial are the mortgage insurance policy is an identical regardless of credit score. FHA home loan insurance policy is determined according to most recent HUD advice and you will does not differ predicated on FICO Rating, or a shortage thereof.

That have FHA money, you only pay a couple of kinds of home loan insurance coverage. You’re the brand new upfront financial advanced that’s a lump contribution quantity of step one.75% financed onto your loan amount if you make the very least off payment of 3.5%. The newest yearly mortgage insurance policy is between 0.80% and step 1.05% for a loan title greater than fifteen years, depending on the loan and down-payment number. Its paid month-to-month provided you have the mortgage.

Virtual assistant financing

The fresh Experts Management will bring qualified energetic duty and veteran people in the newest army that have home loan gurus that will be very different out-of antique and FHA loans. The most notable distinctions were there is no down payment needs no credit history minimum, given that Va recognizes that will has just released veterans who had been towards to another country trips out-of responsibility might not have created a card background. That gives the Va financing a constructed-within the system to possess approving exclusions for veterans no FICO Score.

Comentarii recente