So you should purchase a house, however you don’t believe you’ll get approved for a loan-perhaps you have a below average credit history, limited savings arranged having an advance payment, otherwise a leading obligations-to-money ratio. Many of these activities you can expect to technically count facing you online payday loans Holly Pond if perhaps you were to try to get a conventional financing. Fortunately? Antique funds aren’t the only road to homeownership.

FHA finance are easier for specific borrowers locate recognized to possess while they convey more lenient being qualified guidance, especially when considering offers and you may fico scores. The following is a fast plunge for the FHA financing: what they’re, just who products her or him, how exactly to meet the requirements, ideas on how to use, and the ways to find out if they might be an effective fit for your.

What does FHA are a symbol of?

FHA means Government Housing Administration, additionally the FHA try a government institution that provides mortgage loans. It was created immediately after the great Anxiety, simultaneously when homeownership is actually prohibitively costly and hard to help you get to because so many Us citizens lacked brand new discounts and you may credit history to be eligible for financing. The federal government walked from inside the and you may began support mortgage loans with an increase of available terms and conditions. Recognized loan providers began financing FHA loans, and this considering more modest down-payment and credit rating conditions.

Now, government-supported mortgage loans nevertheless bring a back-up so you can lenders-as a national organization (in this situation, this new FHA) is actually guaranteeing the latest loans, there clearly was faster monetary exposure in the event that a debtor non-payments on the money. Lenders was after that in a position to loosen up the qualifying advice, and also make mortgage loans accessible to center and you can lower income consumers exactly who you’ll maybe not if you don’t feel approved below conventional requirements.

What is the difference in FHA and you will traditional finance?

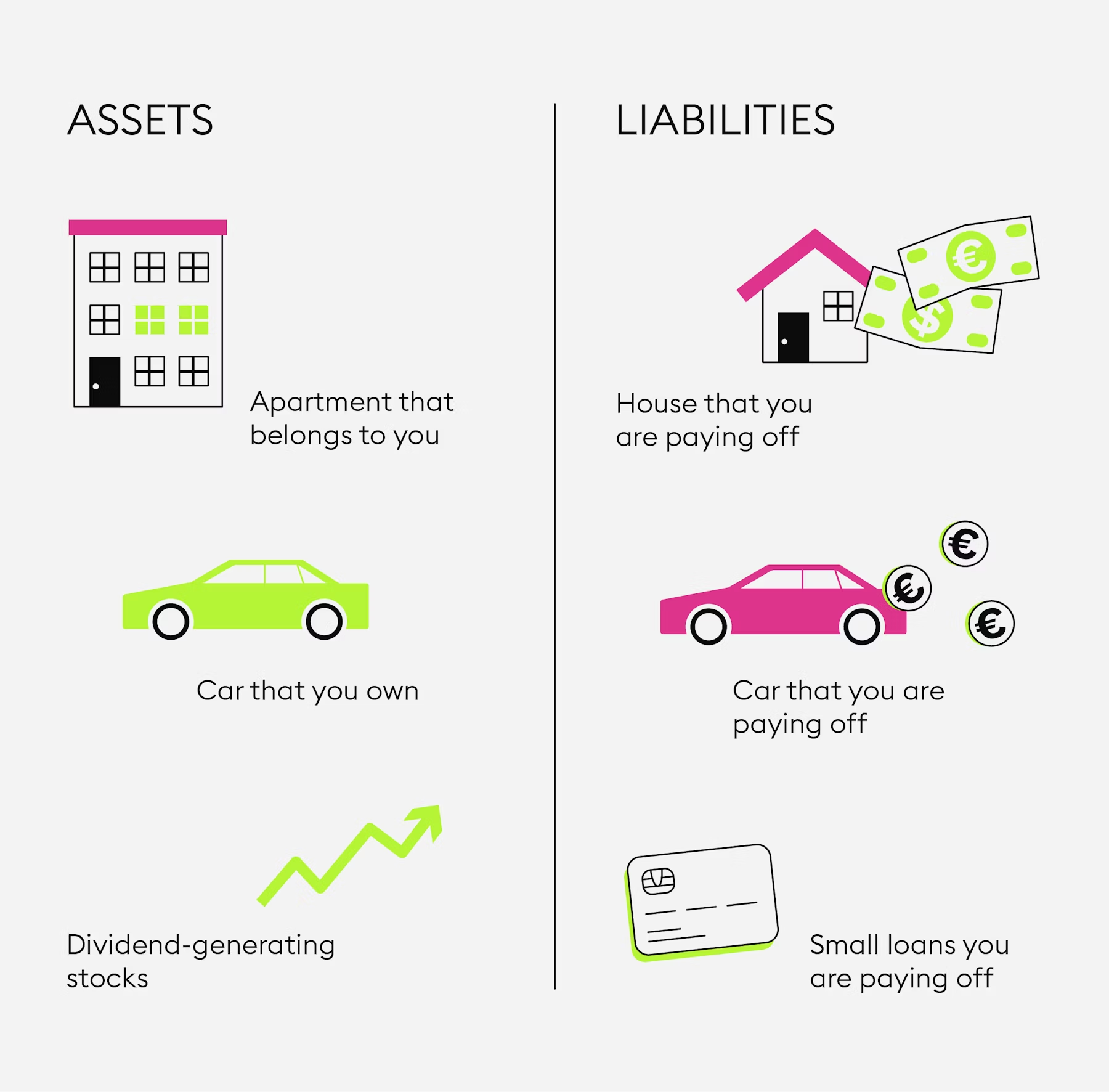

A traditional loan is any home loan that is not insured from the a federal entity. Since the private loan providers guess most of the exposure in the financial support conventional financing, the prerequisites in order to qualify for this type of financing be more rigid. Generally speaking, FHA money will be a good fit for those who have quicker currency set aside to cover the deposit and you may/or if you has a below-mediocre credit rating. If you find yourself low down percentage minimums and you can competitive rates of interest remain you can which have a traditional loan, you will have to show a strong credit history to help you qualify for those individuals gurus.

For every single loan particular has positives and negatives-and additionally other mortgage insurance policies criteria, financing limitations, and you will property assessment guidance-therefore selecting the one which works well with you really is based on your financial character and your homebuying concerns.

FHA funds advantages and disadvantages

FHA fund are supposed to build homeownership way more offered to anyone that have a lot fewer deals reserved and lower credit scores. They’re a great fit for the majority consumers, such as for instance first-time homebuyers who often you prefer lower down percentage selection, nevertheless is weighing the expenses and you may great things about people mortgage prior to committing. The following is a review of the main benefits and drawbacks whether or not it comes to FHA funds:

Ideas on how to qualify for a keen FHA loan

Qualifying to have a keen FHA loan are much easier than just being qualified having a traditional mortgage, however you will still have to fulfill some elementary minimal criteria lay from the FHA. Given that government ensures such fund, brand new investment itself comes thanks to FHA-recognized loan providers (like Greatest Mortgage) each lender have quite more being qualified guidance to have their individuals. Just remember that ,, when you’re this type of FHA requirements promote a standard framework, you’ll need to confirm the person being qualified laws and regulations along with your specific bank.

Credit rating lowest five hundred. Their accurate credit history will play a big role from inside the deciding the deposit minimum; typically, the higher your credit score, the low your advance payment therefore the way more advantageous your attention speed.

Comentarii recente